Entries by Ben Loftsgaarden (23)

China has Stopped Buying U.S. Government Debt

Wednesday, November 30, 2011 at 8:46AM |

Wednesday, November 30, 2011 at 8:46AM |  13 Comments

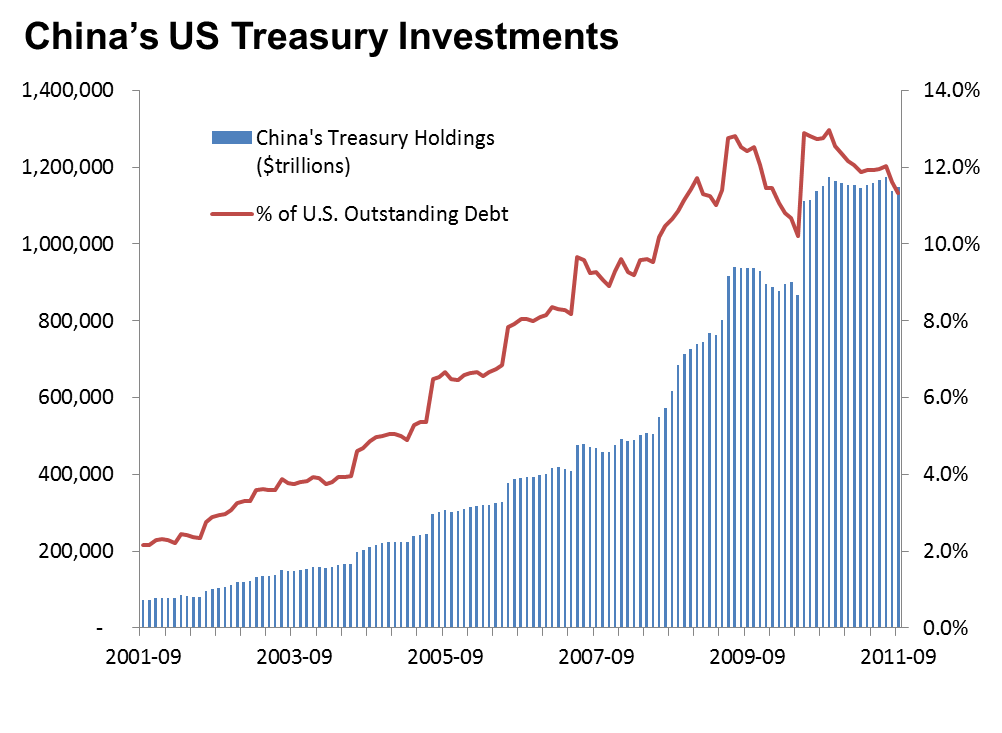

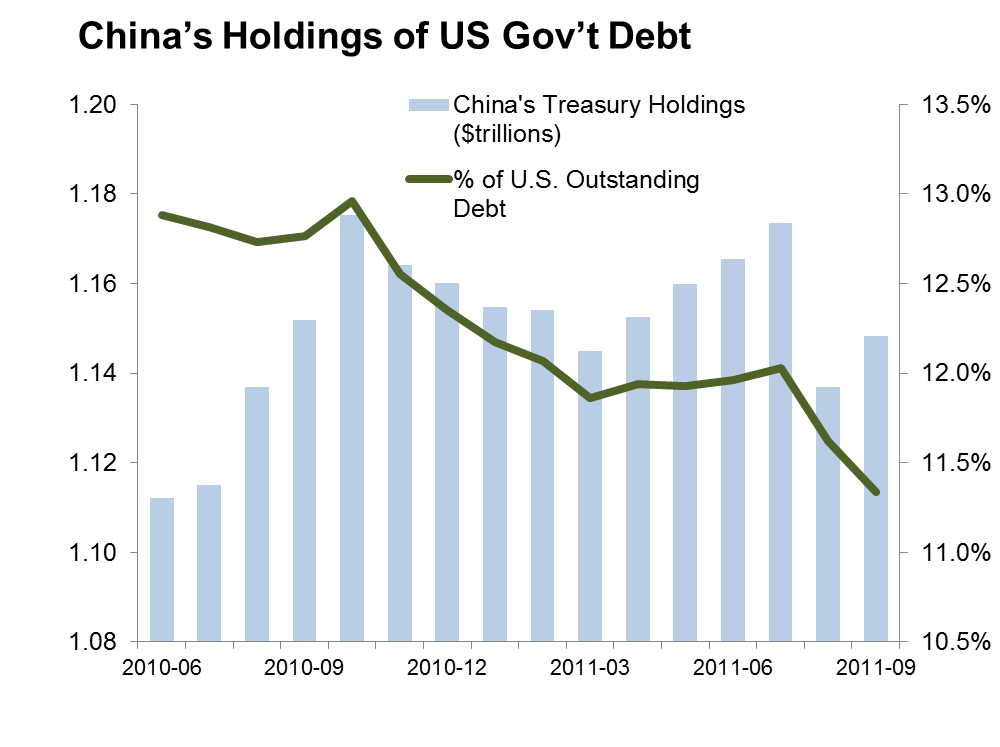

13 Comments The U.S. Treasury Department surveys banks, companies, and governments who own U.S. federal debt on a monthly basis and produces a public report. The detail and accuracy of the report have increased over the years and we now have a decent understanding of who owns U.S. debt and how those positions change over time. The most recent report available, with data through September 2011, highlights an interesting shift in foreign holdings of U.S. debt – China is no longer adding to its position in treasuries, and hasn’t in over a year.

The most consistent trend in the treasury market over the last decade, other than the increasing size of the market, is China’s appetite for treasuries. The U.S. trade deficit with China leaves the Chinese government in possession of large quantities of U.S. dollars. China must then invest these dollars into interest bearing assets, and treasuries have been one of their favorite destinations. China’s treasury holdings increased from $61 billion in 2001 to $1.15 trillion this year. The country became the largest foreign holder of U.S. debt and by the end of 2010 owned 13% of outstanding federal debt held by the public. But over the last 12 months, for the first time in a decade, China stopped adding to its position. While they continue to roll over some maturing positions, overall holdings are flat.

What has changed? This doesn’t appear structural, as the China-US economic relationship is substantially the same, with increasing US deficits offering ample buying opportunities and the large trade deficit still sending US dollars to China every month. It’s also not a diversification strategy, as China’s sovereign investments are well diversified with treasuries accounting for one third of assets. Rather, it appears China has reached its appetite for U.S. government debt, at least in the short run. This raises key concerns for the U.S. as the country needs to sell large amounts of additional debt over the next decade. While the current economic crisis has increased global demand for treasuries, losing one of the largest buyers of new debt will have an impact.

Thai Floods are Serious Risk to Economy

Wednesday, November 16, 2011 at 4:45PM |

Wednesday, November 16, 2011 at 4:45PM |  1 Comment

1 Comment Most articles about the economic impact of the recent flooding in Thailand focused on quantifying the cost of repairing damage. While certainly meaningful short term cleanup costs are much less important than the damage to the country’s reputation amongst multinational manufacturing firms.

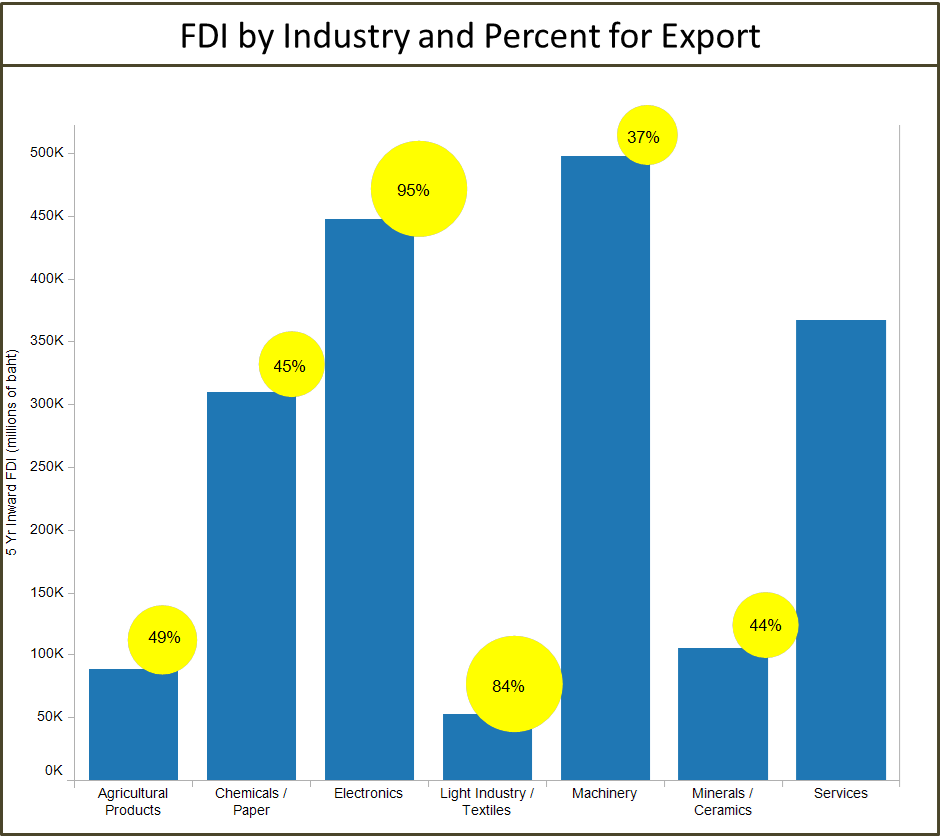

Thailand’s economy is heavily dependent on exports of manufactured goods, primarily by foreign multinational firms. Manufacturing contributes 34% of Thai GDP, much higher than peer countries. Most of this manufacturing base is export oriented, with exports of manufactured goods equaling 71% of GDP, compared to 27% in China and less than 15% in Japan, Brazil, or the United States. Export oriented manufacturing is even more important to Thai economic growth and is easily the largest contributor to growth over the last five years. Manufacturing exports are both the economic base and the main economic driver.

Any slowdown in foreign investment will directly impact GDP growth. In the near-term through less construction activity, and medium-term though fewer jobs and exports. You can see from the chart below the majority of foreign investment in Thailand is goods for export to other countries. The percentage designated for foreign markets increases as the products move up the value chain with 95% of electronics investment being export oriented.

Plenty of these companies feel wronged by the actions of the Thai government, and they have a point. The Industrial Estate Authority of Thailand (IEAT), a division of the Ministry of Industry, created all 38 of the country’s industrial estates and manages or co-manages all 38. The IEAT and private investors both own industrial estate assets. The government chose the location of the industrial estates, created federal incentives not applicable outside the estates, and provided inadequate flood preparation. Some companies negatively impacted by the floods will be upset and blame the government. Existing firms are not likely to leave, as the relocation costs outweigh the benefits, but they may decide to expand outside Thailand in the future. Companies and site selection consultants are certainly less likely to consider the country when shopping site selection projects among countries in Southeast Asia.

Reputational risk is even more pronounced for the Ayutthaya Province and its large industrial estates. The historic province, once the seat of the Ayutthaya Kingdom, is one of Thailand’s economic drivers with four large industrial parks popular with multinational manufacturing firms. Manufacturing accounts for 85% of the province’s GDP and 11% of the country’s total manufacturing output.

The government needs to develop a credible plan convincing investors this won’t happen again. Any plan must address improvements in country wide flood management systems and in specific industrial estate defenses. Any plan needs to convince an uninvolved third party the industrial estates will be better prepared next time.

Flooding in Thailand and Site Selection Due Diligence

Tuesday, November 15, 2011 at 4:19PM |

Tuesday, November 15, 2011 at 4:19PM |  1 Comment

1 Comment Thailand provides a compelling value proposition for manufacturing firms, particularly as an alternative to China, India, and Malaysia. The country offers a strong workforce, solid infrastructure, and foreign firms may own 100% of their local operations, which is typically not possible in many competing locations. Thailand is politically stable (as it relates to foreign manufacturing firms) and has a long history of friendly relations with the West. Of course recent widespread flooding highlights one of the less appealing aspects of central Thailand. Which begs the question, why did so many sophisticated companies locate important facilities in the flood prone Chao Phraya River basin?

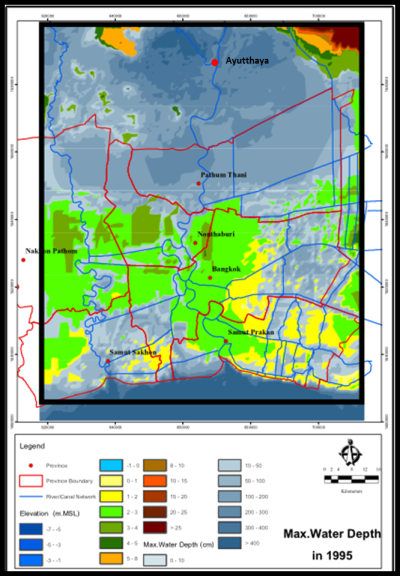

Disasters happen, and one can’t mitigate every risk, but the majority of are predictable and can either be avoided or properly planned for. The flooding Thailand appears to be an example of poor site selection and poor disaster planning and preparation. Thailand and greater Bangkok are prone to flooding. Much of the country is low lying land with large volumes of rain concentrated in a handful of months of the year. The Ayutthaya Province, home to over 11% of Thailand’s manufacturing, is particularly disposed to flooding. The Chao Phraya River bifurcates the province and the Province’s average elevation is only 20’ above sea level. According to a 2009 World Bank study, “In the Chao Phraya River Basin, there were exceptional large floods in 1942, 1978, 1980, 1983, 1995, 1996, 2002 and 2006.”

The 1995 floods were quite severe, with most of the Ayutthaya Province inundated. Existing industrial parks were threatened during these floods but escaped without significant damage. The attached map shows the extent of flooding in 1995, with areas surrounding the industrial parks under between six feet and 10 feet of water.

The current floods impacted thousands of firms including large multinational manufacturers, including Honda, Nikon, and Sony. These firms are a microcosm of Japanese manufacturing, companies that face rising costs and a strong Yen at home and have aggressively expanded production to other nations. Interestingly most of the firms impacted are Japanese, while many of the South Korean and American firms were located in other areas of Thailand.

Large organizations, government of private sector, disincentivize risk. The adage, “you don’t get fired for hiring IBM” is still pretty true today. In site selection, many companies follow their peers when siting new projects, particularly in foreign markets. This manifests itself in Thailand with most foreign corporations locating in state-sponsored industrial estates (as industrial parks are commonly called) located in 3-4 central provinces. The Thai government further drove this consolidation with incentives tied to locating in these industrial parks. Good reasons exist to locate near suppliers and competitors, but it shouldn’t take the place of proper due diligence.

Market Access in China

Friday, November 11, 2011 at 10:04AM |

Friday, November 11, 2011 at 10:04AM |  1 Comment

1 Comment The famous auto executive Bob Lutz was on Charlie rose last night and he made an excellent point about China’s development strategy. Mr. Lutz said;

“China, when they developed their auto industry, they welcomed partnerships with western companies, especially American ones. The Japanese and the Koreans were absolutely mercantilistic and kept everybody out until their industry was big and powerful.

Everybody says, well aren’t you afraid of the Chinese? I’m not afraid of the Chinese because as the Chinese automobile industry develops General Motors is one of the biggest players.”

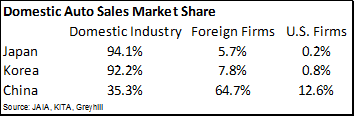

It’s an excellent counter point to the criticism many raise about market access in China. Opening large sectors of the Chinese economy to foreign firms, even with local partnership requirements, is better for the U.S. than the closed development model favored by Japan and South Korea.

Japan and South Korea closed their domestic markets to foreign competition, built up a competitive domestic industry, and then slowly opened their markets. Imports blocked with punitive tariffs and foreign companies were not allowed to build local manufacturing plants. Those restrictions were relaxed over time but foreign firms hold very little market share in either country.

China encourages foreign investment in the auto sector but requires a partnership with a local firm. They are using foreign expertise to build the domestic industry. Foreign firms maintain strong market share that Mr. Lutz believes is long-term sustainable as Chinese auto companies become more competitive. The Chinese model seems better for the U.S.

Interview with Mr. Lutz below.

Flooding in Thailand - Ayutthaya Province

Tuesday, November 8, 2011 at 11:37PM |

Tuesday, November 8, 2011 at 11:37PM |  2 Comments

2 Comments

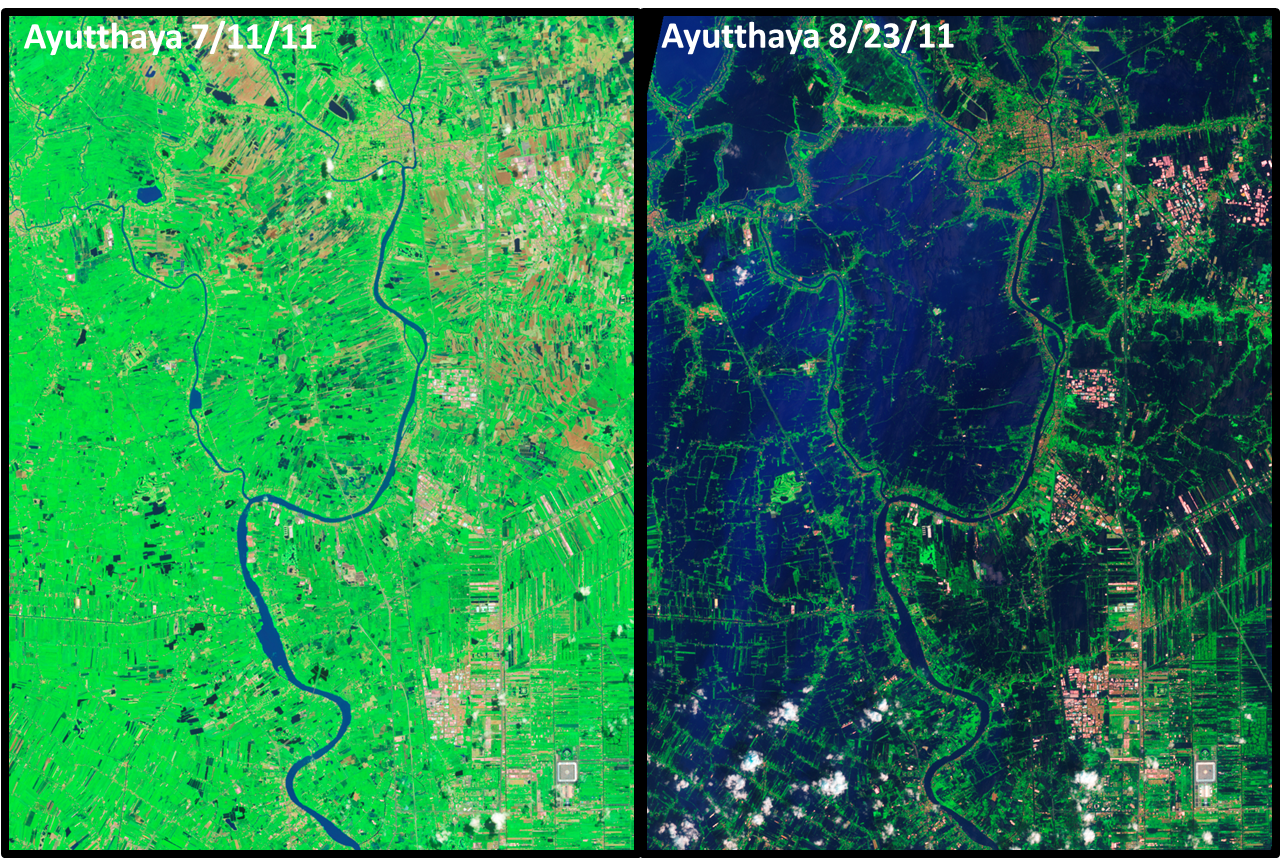

The Ayutthaya Province is the backbone of the Thai economy and accounts for greater than 10% of the country's manufacturing output. The province is home to large concentrations of electronics and automotive manufacturers with Honda, Sony, Nikon and Western Digital among the hundreds of multinationals operating in the province. The two images above use "false color" to help accentuate the extent of the flooding, green is land and dark blue is water. As you can see, the significant majority of the province is inundated, including four of the largest industrial parks in the country. The disaster provides a real world case study on the importance of natural disaster risk mitigation in site selection. We'll discuss in more detail tomorrow.

Red Cross of Thailand - http://english.redcross.or.th/home

Photo Source: NASA Advanced Land Imager - http://goo.gl/M4uYG

Why Greece Should Default and Devalue - in Three Charts

Tuesday, November 1, 2011 at 9:43PM |

Tuesday, November 1, 2011 at 9:43PM |  13 Comments

13 Comments The headline is superfluous, as Greece defaulting on its debt is a mathematical certainty. The only alternative is for another country to pay the debt, which is more likely than Greece paying the debt off, but not much. While default is a certainty, the Eurozone seems to be avoiding the issue entirely. More importantly, after default Greece will leave the Euro, adopt the New Drachma, and rebuild its economy. I believe this is not only likely to happen, but the only sensible choice. Greece leaving the Euro allows Greece to survive and the Euro member states to allocate limited resources to shoring up countries more likely to avoid default.

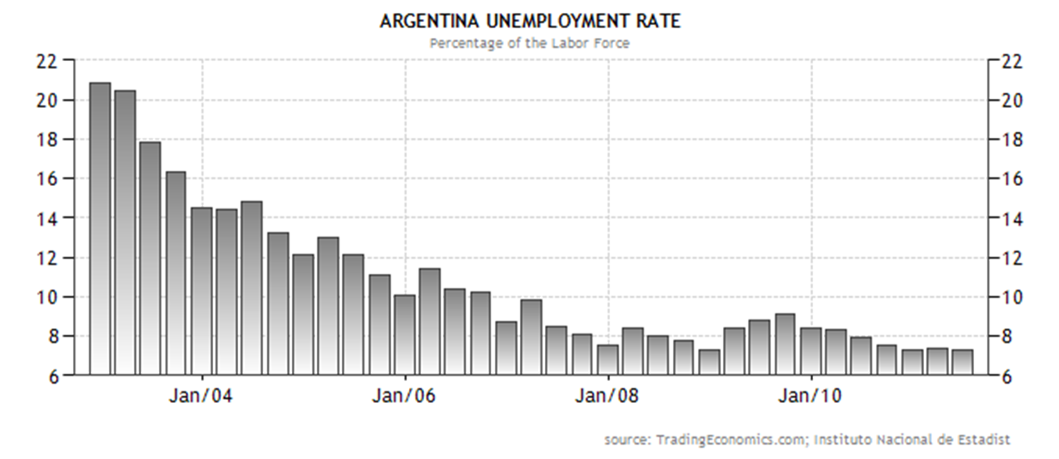

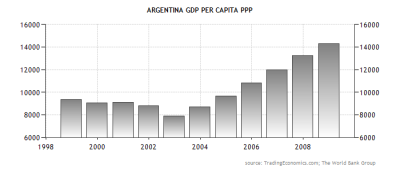

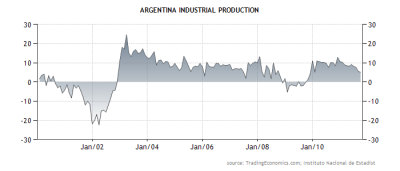

Most important for Greece is that leaving the Euro and adopting a devalued local currency is a strategy than can work. Argentina defaulted on its debt and devalued the local currency in 2002 and here are the results.

Unemployment Rate

GDP per Capita (PPP)

Industrial Production

Default is not an ideal situation, but history shows a country can survive it. I'm not sure Greece can survive another decade of 20+% unemployment.

Local Government Finances

Monday, October 31, 2011 at 9:33PM |

Monday, October 31, 2011 at 9:33PM |  9 Comments

9 Comments The New York Times article on Rhode Island’s pension system “Little State with a Big Mess” is an excellent read. Rhode Island is a microcosm of the national issues of public sector debt, pensions, and the political difficulty in rebalancing government finances. Rhode Island’s pension problem is best articulated through three facts. First, the state has more retirees than current state workers, a problem facing many old industrial firms in the U.S. Second, and more importantly, the Times stated,

“In each of the last 10 years, the state pension fund paid more money to retirees than the fund collected from state employees and taxpayers combined.”

Lastly, the state pension fund assumes annual returns of 8.25%, versus the actual return of 2.4% a year over the last decade. Clearly not a sustainable path for the state. The situation in Europe and Greece reinforces why this is an important issue and one best tackled in a timely manner, before it becomes a crisis. My friend Bill says, “Bad news doesn’t get better with age.” Not only will the cuts be more painful in a crisis, but the political calculus becomes more complicated. Europe has been fighting to solve the crisis for Greece with half measures and the situation threatens to boil beyond their control.

The article reminded me of the role local and state government finances play in corporate site selection. It’s an important issue that doesn’t get much coverage. Site selection consultants evaluate state and local government credit ratings and overall finances during the site selection process. If the client cares about tax rates, they certainly care about the potential for future tax rate increases. U.S. states are generally considered low risk by the rating agencies as you can see from the map below. Although it is worth noting California’s credit rating is lower than the recently downgraded Italy.

A state with serious existing fiscal problems, which is cutting services and raising taxes, is less appealing than the alternative. A looming fiscal problem is a forecast for service cuts and tax increases. The political process to solve a serious fiscal problem is never fun. The ensuing fight will only worsen political infighting and corporate end-users are sure to be targeted for tax increases. When has a tax increase not caused trouble?

Locations of most concern:

- States and cities downgraded or put on a ratings watch by a major credit rating agency.

- Company towns or small cities with a concentrated tax base.

- Cities and states with limited flexibility in budgeting or taxing.

Resource: http://www.municipalbonds.com/ Excellent site. Free registration provides access to state and municipal bond ratings, current yields, and related research.

More Questions About Litebox

Friday, October 28, 2011 at 8:32AM |

Friday, October 28, 2011 at 8:32AM |  6 Comments

6 Comments I was too polite about Litebox yesterday. No way this project is real. It could become a real project one day, and I hope it does, but the facts released to date don't lend credibility. In addition to the questions raised by the Indy Star and in our post yesterday, the project numbers just aren’t plausible.

Employee Density – 900 employees in 125,000 square feet, or 140 sq. ft. per employee. I looked back through our past projects and couldn’t find a project with even twice that density. The national average for manufacturing is over 500 sq. ft. Transportation equipment manufacturing is even higher due, in part, to the large size of the finished product. Each tractor-trailer is 500 sq. ft. This number isn’t in the ballpark of reality, which means the 125,000 sq. ft. building requirement isn’t a real requirement.

Construction Timeline – Begin construction in 60 days and be completed by late spring. A seven month process isn’t realistic with no architects, engineers, or contractors hired, and no site development or building permits issued. Litebox does not appear to have an established manufacturing process, which takes time and expertise to develop. And I don’t know about Indiana, but winter usually slows the construction process down a bit as well.

A plausible answer exists for each issue raised about Litebox, but not in the aggregate. Hopefully the company figures out the details and this ends up just being a premature press conference and public announcement.

Red Flags on Litebox Inc.

Wednesday, October 26, 2011 at 3:15PM |

Wednesday, October 26, 2011 at 3:15PM |  13 Comments

13 Comments The Indianapolis Star reports Litebox Inc. plans a new manufacturing facility in Indianapolis. A quick look at Litebox Inc. sends up red flags. I'm all for government taking chances on new companies, especially when any incentives are tied to actual job creation and investment. And I happen to believe Indiana has some of the strongest, smartest elected officials and economic development organizations in the nation, but Litebox doesn't pass the smell test for me.

- Litebox Inc. is a Delaware Corp using a registered agent in Wyoming. The company does not appear to be registered to do business in either California or Minnesota.

- Finance tracking tools show no funding announcement for Litebox or Mr. Yanagihara.

- I'd be quite surprised if Panasonic or Bose allowed the use of their logo in that manner.

I'm guessing people in Indianapolis came to the same conclusion and are looking into the matter. Here are a few options for Mr. Yanagihara to clear this all up.

- Provide a copy of the Litebox contract with Panasonic or Bose

- Provide a copy of the Litebox funding commitment papers

- Provide a copy the Litebox California tax return, workers comp payment slip, or lease contract

- Even the business name Litebox operating under in California or Minnesota

I hope I'm wrong, my research was inaccurate, and that Indianapolis gets every one of those jobs.

Edited to add - No way you can fit 1,000+ employees in a 125,000 square foot manufacturing space. Production equipment, parts and materials storage, and the actual trucks take up space. A call center might have that employee density, but not manufacturing.